workers comp taxes texas

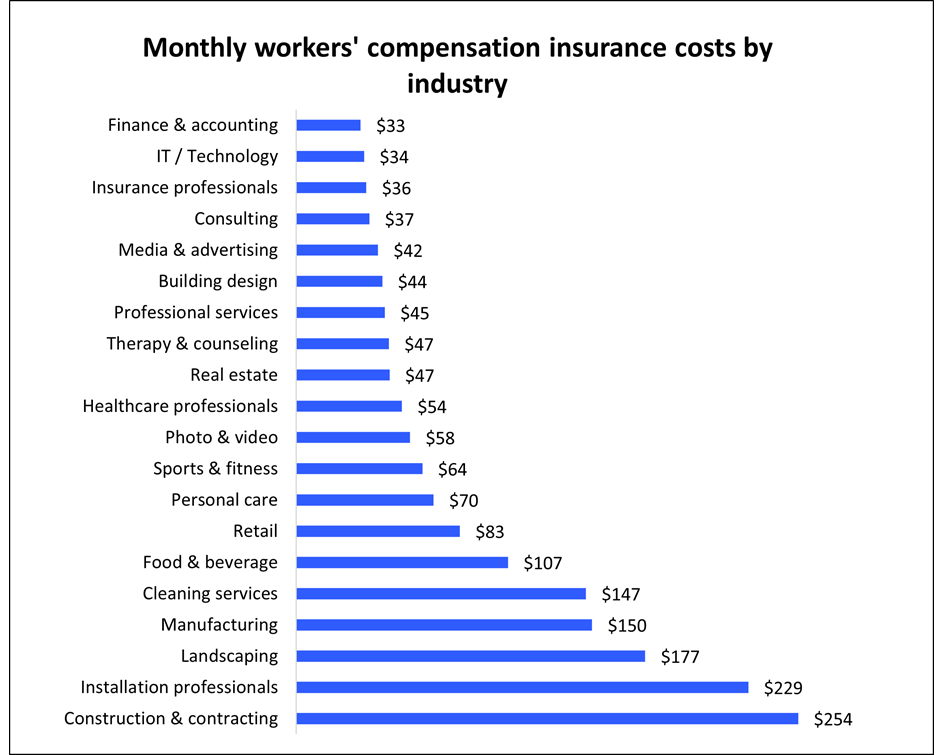

In General Workers Comp Settlements Are Not Taxable. Employer costs for unemployment insurance and workers compensation are relatively low in Texas.

Is Workers Comp Taxable Hourly Inc

Unemployment Insurance Workers Compensation.

. For workers compensation questions concerning the Uvalde event visit our staff at Family Assistance Center Uvalde County Fairplex 215 Veterans Lane or call us at 800-252-7031. Per the IRS you are not required to pay tax on the funds you receive from your workers compensation. Minimum Tax Rate for 2022 is 031 percent.

Workers Comp Exemptions in Texas Sole-Proprietors and Partners. The Texas Department of Insurance is working hard to provide you with information you need to make informed choices about workers compensation insurance. Sign it in a few clicks.

Edit your injury workers compensation texas online. Limitations of Workers Comp Benefits. You do not need to claim the income benefits from workers compensation you receive on your taxes.

If you are receiving workers compensation benefits and have questions or concerns about which portion if any is taxable. If tax is paid over 30 days after the due date a 10 percent penalty is assessed. The Medicare tax rate is 145 of all earnings of both employees and employers.

If you have any. You pay unemployment tax on the first 9000 that each employee earns during the. Maximum Tax Rate for 2022 is 631 percent.

Texas requires that all businesses involved in projects for government entities carry workers compensation insurance. Is workers Comp taxable in Texas. Call an Experienced Workers Compensation Attorney Today.

As you can see there are limits to workers comp. In most cases the payments received through workers compensation are exempt from taxation in the state of Texas. Workers compensation settlements are not taxable in Texas.

The short answer is. For the most part you will not have to list workers compensation settlement money as income when filing your. Subscribing to workers compensation insurance puts a limit.

Texas unlike other states does not require an employer to have workers compensation coverage. The benefits from workers compensation are typically not taxable in Texas. Up to 25 cash back Workers comp will also pay up to 10000 for burial expenses.

Type text add images blackout confidential details add comments highlights and more. Past due taxes are charged. Additional Medicare tax needs to be paid depending on the filing.

If tax is paid 1-30 days after the due date a 5 percent penalty is assessed.

:max_bytes(150000):strip_icc()/workerscompensation-82c488f6cf5d4431a994ecfdc8373f4f.jpg)

Does My Business Need Workers Compensation Insurance

The Fallout Of Workers Comp Reforms 5 Tales Of Harm Propublica

Texas Workers Compensation Laws Costs Providers

![]()

Texas Nanny Tax Rules Poppins Payroll Poppins Payroll

Texas Workers Compensation Lawyer Free Consult The Zimmerman Law Firm

Is Workers Comp Taxable Hourly Inc

When Does Workers Comp Start Paying Benefits Or When They Should

Are The Benefits From Workers Compensation Taxable In Texas D Miller

How Will The New Tax Rate Affect Texas Workers Comp

Texas Workers Compensation Insurance Laws Forbes Advisor

Dwc Form 83 Fill Online Printable Fillable Blank Pdffiller

2020 Guide To Texas Workers Compensation Stats Foresight

Texas Mutual Insurance Company Austin Chamber Of Commerce

Ibaw 5 Star Workers Comp Texas Mutual

Texas Workers Compensation Commission Simmons And Fletcher P C

Texas Small Business Scorecard March 2019

Texas Workers Compensation Handbook Lexisnexis Store

Is Workers Compensation Taxable In Texas Thompson Law Call 24 7